A vast majority of seniors take prescription drugs, with nearly 9 out of 10 seniors taking at least one prescription medication and more than half taking at least four. Despite more than 60 million Americans getting prescription drug benefits through Medicare, another report revealed that, in 2022, 1 in 5 adults ages 65 and up either skipped, delayed, or took less medication than was prescribed or took someone else’s medication due to the cost. Prescription costs will likely continue to impact seniors, with prices continually on the rise, including more than 700 medications increasing in price as of January 2024.

February is National Senior Independence Month, which is dedicated to recognizing resources for seniors that help them live independent and full lives. In light of that, SingleCare analyzed its data on the top medications filled by seniors to reveal how much they can save on their medications at the pharmacy.

Seniors save an average of $114 per prescription with SingleCare

SingleCare discovered that in 2023, across the top 100 most commonly filled medications for older adults (ages 65+), they saved an average of $114 per script and saved an average of 77% compared to the out-of-pocket retail cost at the pharmacy when using SingleCare.

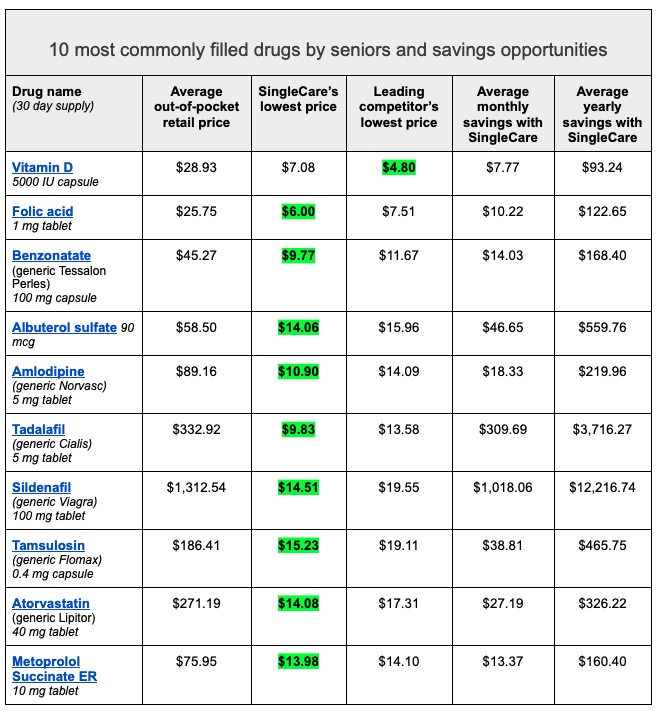

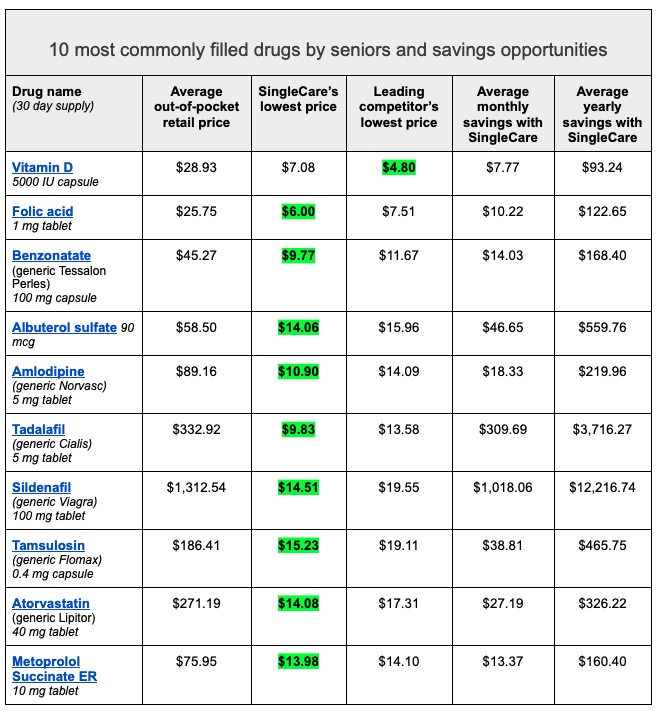

The chart below illustrates the 10 most commonly filled prescriptions with SingleCare by patients 65 and older and the potential savings on these medications.

Understanding your Medicare Part D benefits

After becoming eligible for Medicare, many seniors use Medicare Part D prescription drug plans to help cover the cost of their medications. Seniors have the option to enroll in standalone Part D plans (PDPs) or choose a Medicare Advantage plan (Part C) that includes prescription drug coverage.

Seniors with limited incomes may qualify for Extra Help, also known as the Low-Income Subsidy (LIS), which helps cover Medicare Part D premiums, deductibles, and copayments. Eligibility criteria and benefits vary based on income and resources.

Seniors can use online tools provided by Medicare or consult with licensed insurance agents or counselors to compare Part D plans based on their medication needs, preferred pharmacies, and financial considerations. It's essential to review plan details annually, as coverage and costs may change from year to year.

However, even if seniors are enrolled in Medicare Part D—which covers many prescriptions and some vaccines—not all drugs are covered. The cost of covered prescriptions and vaccines varies by plan and coverage stage.

“Seniors may face various barriers to medication adherence, including high costs of medications,” says SingleCare’s Pharmacy and Health Expert, Jennifer Bourgeois, Pharm.D. “By exploring various cost savings options, seniors can make informed decisions to ensure their medications are covered at the lowest possible cost, promoting financial stability and medication adherence.”

5 prescription tips to help seniors save

“For seniors, medication adherence is crucial for managing chronic conditions, preventing disease progression, and maintaining overall health and well-being,” Dr. Bourgeois says. “Many seniors have one or more chronic health conditions, such as hypertension, diabetes, heart disease, or arthritis, that require ongoing medication management. Adherence to medications prescribed for preventive purposes, such as statins for cardiovascular health or osteoporosis medications, can help reduce the risk of disease progression and associated complications, particularly as individuals age. Non-adherence to medications can lead to exacerbations of chronic conditions, worsening symptoms, and increased risk of hospitalizations or emergency room visits.”

It’s important that seniors understand how to save money at the pharmacy. Dr. Bourgeois shares her five pharmacist tips for how senior consumers can navigate rising prescription costs.

Generic alternatives: One of the most effective ways to save on prescription medications is to opt for generic versions of prescribed drugs. Generic medications are just as safe and effective as their brand-name counterparts but often come at a fraction of the cost.

Use prescription discount cards for excluded medications: Some prescription plans do not cover certain medications. Explore the option of prescription-saving services, like SingleCare, to help decrease your overall out-of-pocket expense. SingleCare can help you save up to 80% on your prescription medications and are often cheaper than a copay so it’s always worth checking.

Review your current medications: Start by compiling a list of your current medications, including dosages and frequencies. This will serve as a valuable tool when evaluating different prescription coverage options. Take note of any changes in your health or upcoming treatments that might affect your medication needs.

Review network pharmacies and your plan’s formulary: Check the network of pharmacies associated with each plan. Using an in-network pharmacy can result in lower out-of-pocket costs. Confirm that your preferred pharmacy is part of the plan's network, and consider the convenience and accessibility of these locations. Before you choose a plan, review the formulary to see which drugs are covered under the plan.

Shop around for the best prices: Prices for prescription medications can vary between pharmacies. Take advantage of online tools and apps, like SingleCare, that allow you to compare drug prices at different pharmacies in your area.

Methodology: Prices compare the lowest prices available on SingleCare and the leading competitor as of Feb. 5, 2024 for included drugs; average retail price sourced among CVS, Walgreens, Albertsons, Kroger, Meijer, Rite Aid, and Walmart pharmacies. Consumer potential savings based on all scripts filled using SingleCare in 2023 by patients 65 and older; based on 30 day supply.