The average American spends more than $1,300 annually on their medications—more than any other country in the world—and as many as 18 million Americans are unable to afford their medications. With historic inflation rates and the costs of goods rising, more Americans are skipping their medications due to cost, crippling adherence and contributing to an overall decline in health.

SingleCare, the free prescription savings service, surveyed more than 1,000 people in the U.S. to better understand attitudes about prescription affordability and how these costs impact everyday purchasing decisions of Americans. In addition to its survey, SingleCare also evaluated its prescription prices nationwide against the leading competitor to see how they compare — as SingleCare aims to offer the lowest prices on the drugs people fill most often.

Nearly half (48%) of Americans find it more difficult to afford their prescriptions this year compared to previous years.

In the SingleCare survey, 83% said they take at least one prescription each month, with 20% taking five or more. Access and adherence to prescription medications is incredibly important, especially for those who have a chronic condition. SingleCare’s survey revealed that the recent turbulent economic climate has made it even more difficult for Americans to afford their prescriptions.

42% said rising inflation rates have made it more difficult for them to afford their prescription this year

48% of Americans said that they find it more difficult to afford their prescriptions this year compared to last

52% said they’ve noticed an increase in their prescription prices over the past year

37% said they’ve used their savings account in order to pay for their prescription

39% said they’ve skipped a prescription refill at least once due to cost

39% said they’ve compromised purchasing other goods in order to afford their prescriptions

Despite prescription savings options, consumerism has yet to infiltrate the pharmacy.

SingleCare’s survey revealed that 53% of respondents have not used a prescription savings card. Consumers are still unaware of free services, like SingleCare, that provide the ability to save up to 80% on medications, which can be less expensive than the cost of an insurance copay. The survey also found that…

The majority (61%) said they rarely or never compare prescription drug prices at various pharmacies before filling their prescription

More than half (54%) rarely or never compare the cost of their copay to the retail price of the prescription drug

SingleCare beats the leading competitor’s price 91% of the time nationwide.

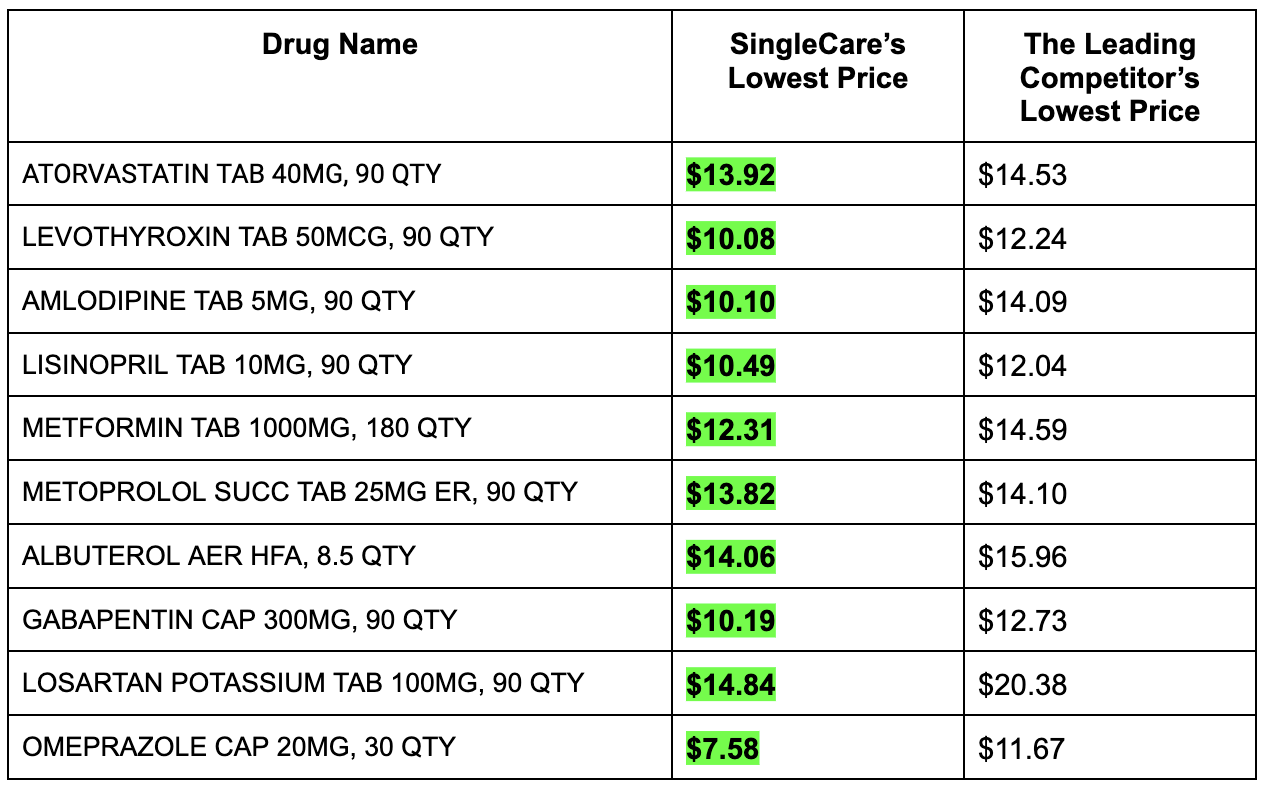

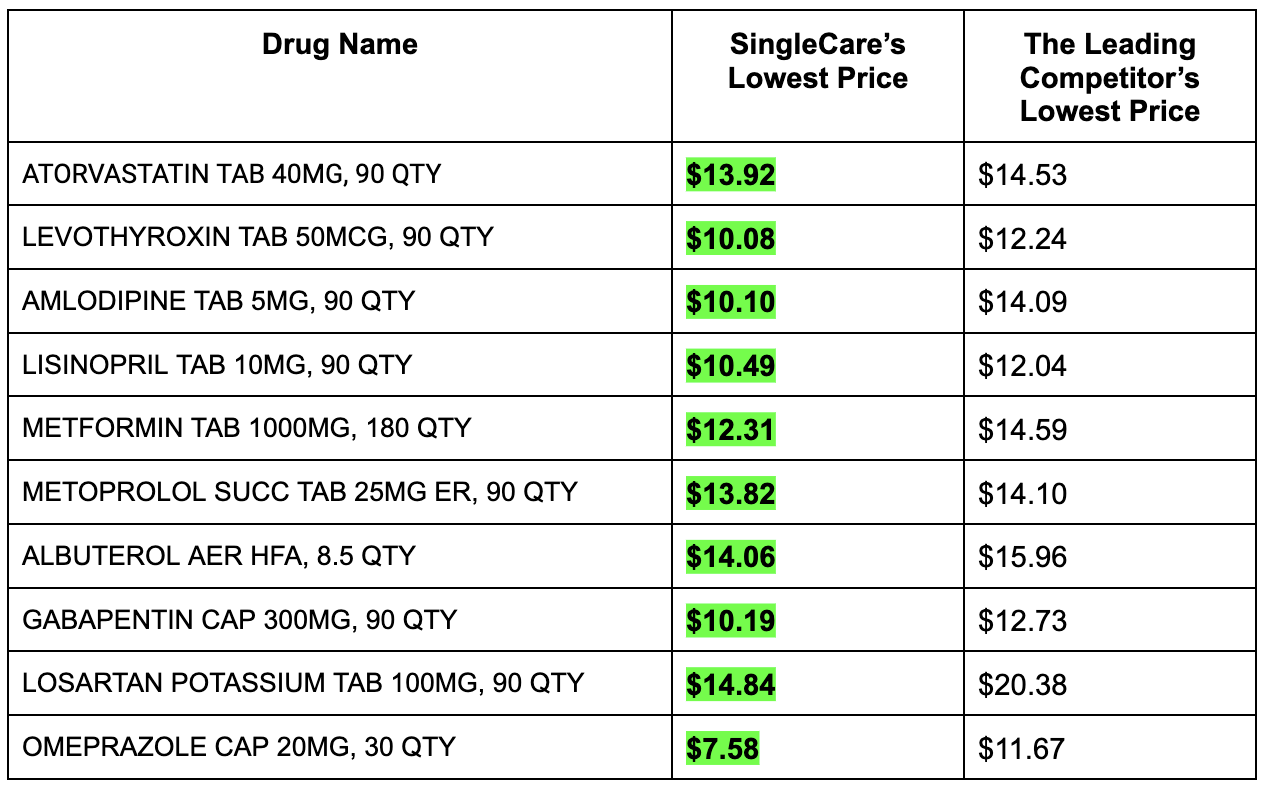

SingleCare compared its prescription prices to the leading competitor at pharmacies nationwide and found its service beats their prescription prices 91% of the time across IQVIA's top 100 dispensed drugs. Among IQVIA's top 10 drugs, SingleCare beats the leading competitor’s price 100% of the time.

Top 10 commonly dispensed drugs on SingleCare beats the leading competitor price 100% of time at pharmacies nationwide

Data Methodology

Top 100 and top 10 based on most commonly dispensed drugs according to IQVIA data from Jan. 2022 to Sept. 2023, excluding opioids. Prices compare lowest prices available on SingleCare and the leading competitor as of Nov. 3, 2023; lowest prices sourced among CVS, Walgreens, Albertsons, Kroger, and Rite Aid pharmacies.

Survey Methodology

SingleCare conducted this prescription affordability survey online through SurveyMonkey on Jun. 29, 2022. This survey includes 1,083 United States residents, adults ages 18+. Age and gender were census-balanced to match the U.S. population in age, gender, and U.S. region.