Four months after the initial COVID-19 outbreak, Americans continue to face an evolving pandemic landscape as they head into the summer of 2020. While some states have recently seen a flattening or decline in COVID cases, others are experiencing a spike in new cases. Forty million Americans lost their jobs as a result of the pandemic, and an estimated 25 million could lose their health insurance coverage.

SingleCare analyzed consumer prescription demand and fill data in the weeks leading up to shelter in place orders, beginning in March, and the subsequent months after the pandemic to see how COVID has impacted the healthcare trends of Americans.

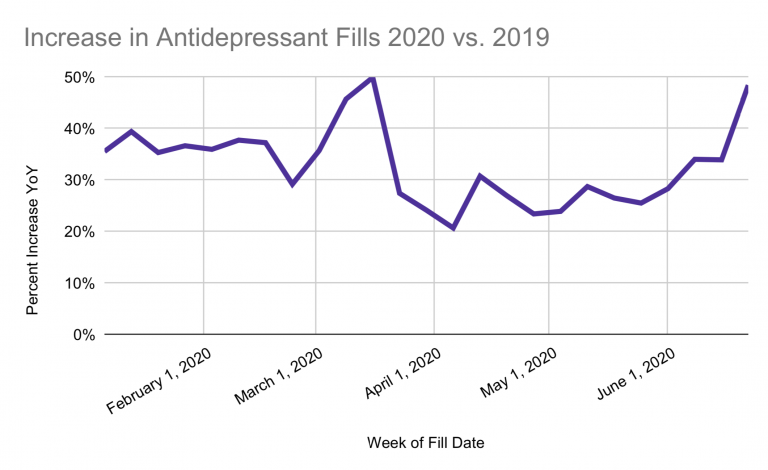

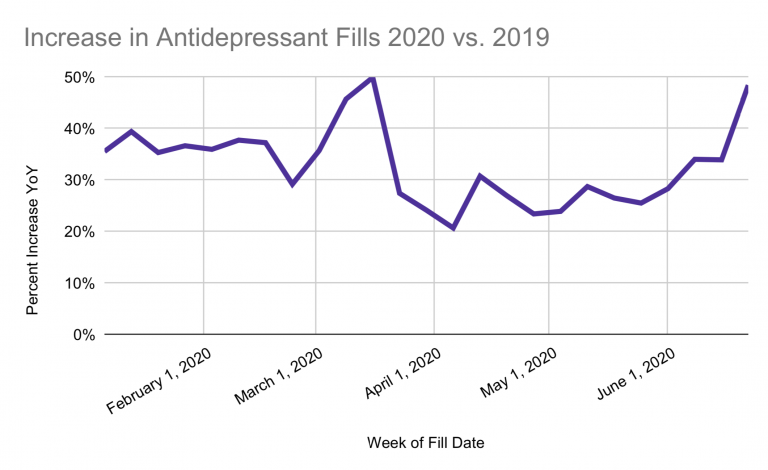

Antidepressant fills spike to new highs

A drug group that has seen significant increases since the start of the pandemic is antidepressants. SingleCare has seen a nearly 50% increase in fills for antidepressants in the third week of June, a similar increase occurred in the third week of March when social distancing and sheltering in place began. In a recent SingleCare survey of 1,000 U.S. respondents, 59% said COVID has affected their mental health. “Between the concern over job loss, isolation, and general anxiety, this growing trend in antidepressants over the past few months may well be due to the pandemic’s impact on mental health,” says Ramzi Yacoub, Pharm.D., the chief pharmacy officer at SingleCare.

Cold and flu decline while allergy and asthma medications surge

SingleCare analyzed the top prescription fills by volume during the months of March to May 2020 and compared those figures to the fills during the same three month period in 2019. Two noteworthy trends: a marked increase in respiratory medications ostensibly to address COVID related symptoms; and a marked decrease in the purchase of cold and flu medications, likely due to shelter-in-pace and quarantine guidelines.

Compared to 2019, SingleCare saw a 41% increase in Albuterol, a common rescue inhaler, 35% increase in cetirizine (the generic version of Zyrtec), and a 44% increase in ibuprofen.

However, the company saw a 19% decrease in fills for benzonatate, a common cough medicine, and a 23% decrease in fills for oseltamivir, the generic version of Tamiflu.

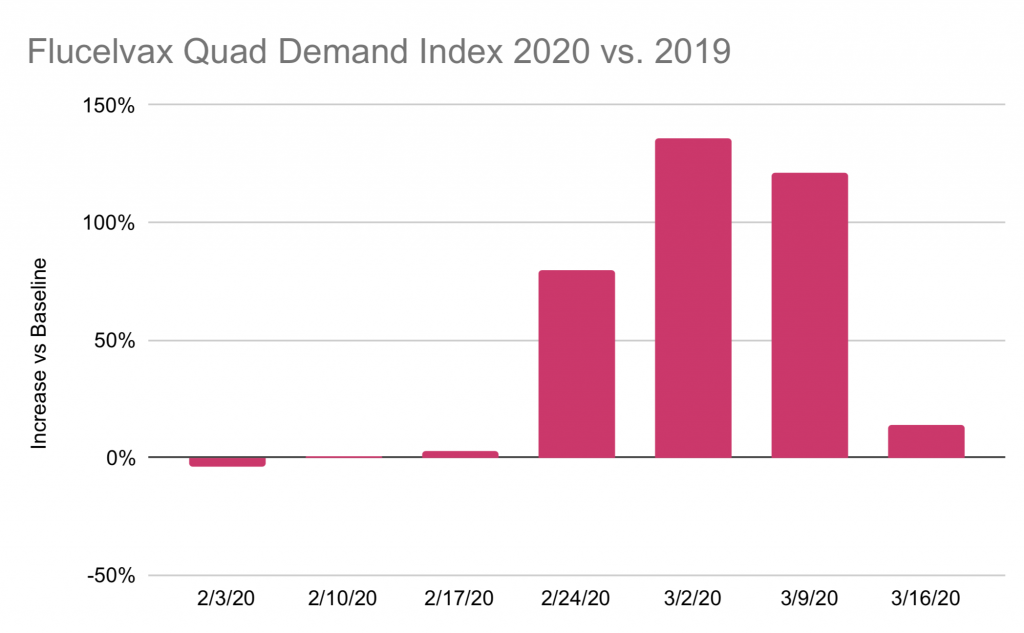

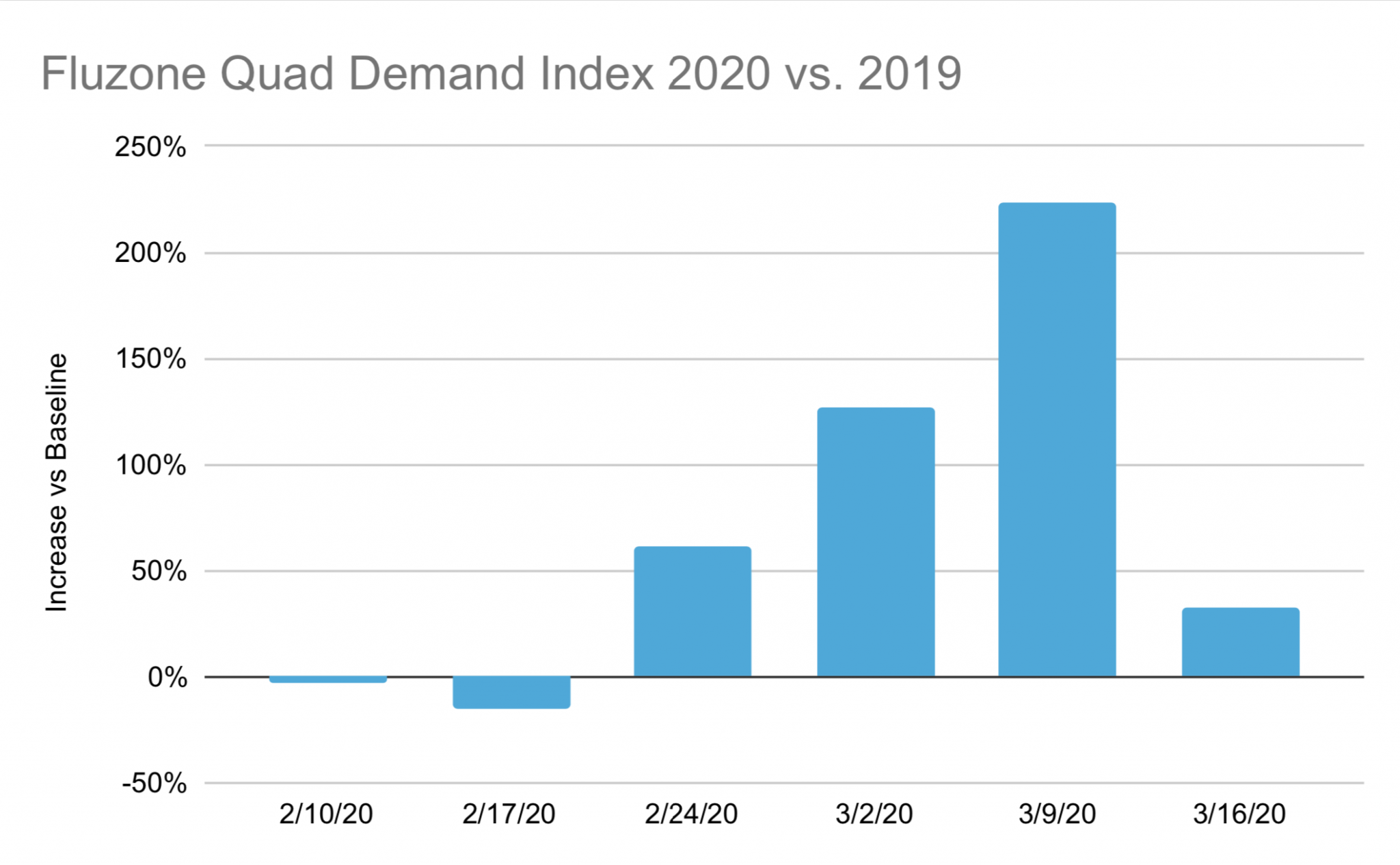

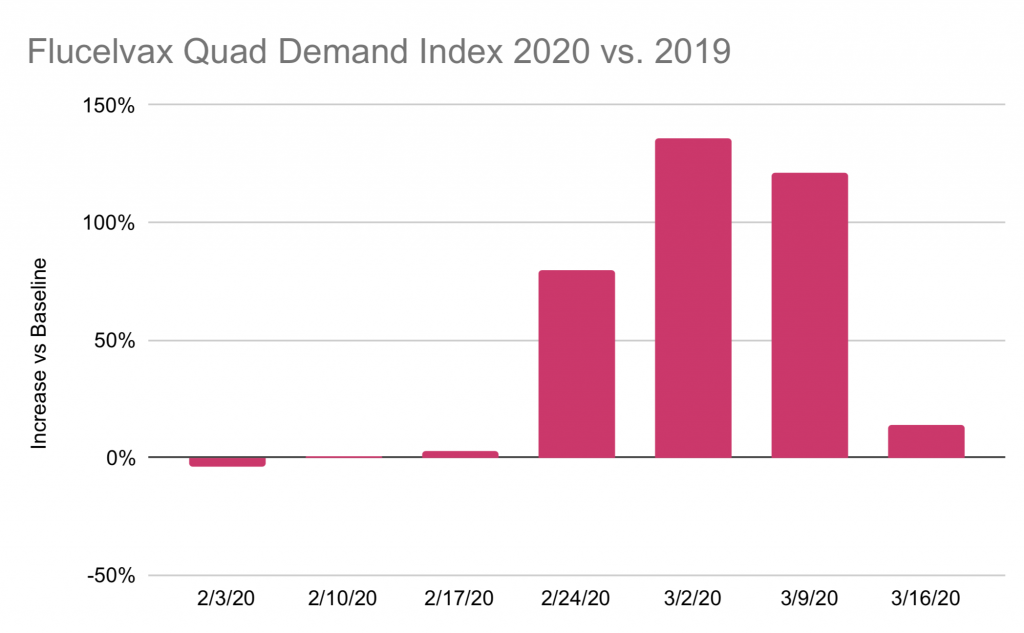

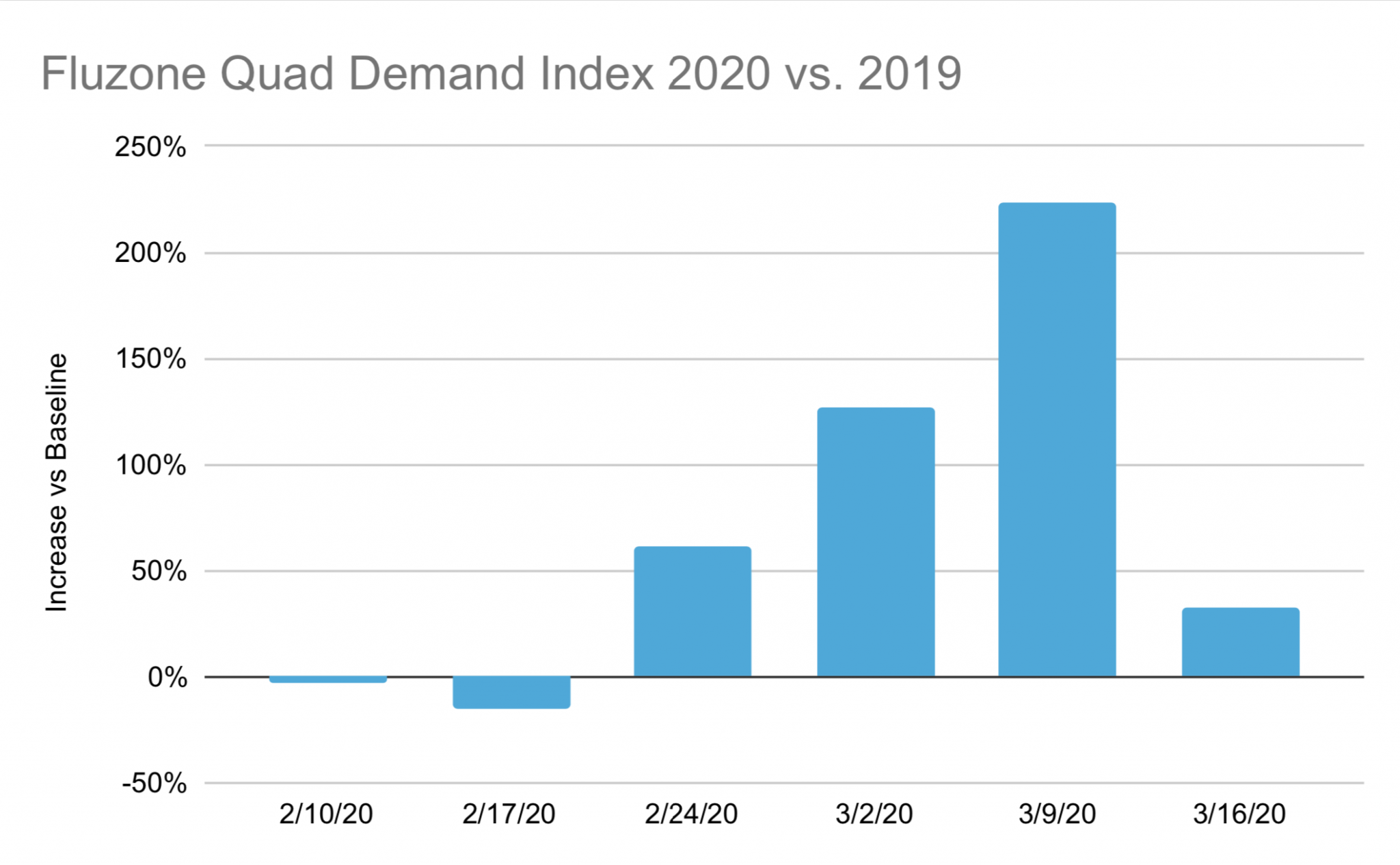

Flu vaccinations increase 500% YoY at the start of the pandemic

While cold and flu medications declined as a result of the pandemic, Americans rushed to the pharmacy for flu vaccines as the threat of COVID emerged, in the weeks before the shelter in place order (despite the fact the flu vaccine is not effective against COVID-19). SingleCare typically sees the majority of flu vaccinations in the fall. However, as the COVID-19 outbreak in the U.S. spread, so did flu vaccine fills:

Comparing the weeks of 2/24 to 3/9 to the same time period last year, SingleCare saw a 507% increase in demand for Flucelvax Quad and a 483% increase in demand for Fluzone Quad.

Comparing the weeks of 2/24 to 3/9 to the three weeks prior, SingleCare saw a 44% increase in demand for Flucelvax Quad and a 56% increase in Fluzone Quad.

The access and affordability of health care during COVID

In a recent SingleCare survey of 1,000 U.S. consumers, 58% said they did not understand how their prescription medications were priced. SingleCare believes in transparency of healthcare pricing and helps consumers access lower prices on prescriptions so that they can continue to adhere to necessary medications. After reviewing the drug categories of the prescription medications previously mentioned, SingleCare saw an overall decrease in the usual and customary (UNC) price for these medications when comparing the time periods of March to May 2020 with March to May 2019.

Prescription drug categoryAvg. UNC Price Mar-May 2019Avg. UNC Price Mar-May 2020Percent ChangeAntiasthmatics and Bronchodilator Agents$90.42$66.40-27% Analgesics (Non-Narcotic)$12.78$10.12-21%Antivirals$112.98$96.65-14%Antidepressants$68.26$66.20-3%

“Various factors can contribute to the pricing of prescriptions, such as demand, number of manufacturers, new generics or brand entrants into the market, and the cost of ingredients,” says Ramzi Yacoub, Pharm.D., the chief pharmacy officer at SingleCare. “The increase in demand for antiasthmatics, antivirals, and antidepressants along with the impact of COVID-19 may have contributed to the overall reduction in the usual and customary cost of these drug groups.”

The SingleCare survey also revealed that 21% stopped taking medications since the pandemic began as a result of cost and/or access, and 27% opted to skip doctor’s appointments due to financial constraints created by the pandemic / recession.

Additional consumer survey insights on the healthcare impact of COVID-19

51% have either skipped or rescheduled doctor appointments or elective procedures due to fear of getting COVID

58% expect to continue to feel the effects of the pandemic / recession for the next 1-3 years

One-third expect to pay between $100-$600 out of pocket for prescriptions this year

32% said they spent some or all of their stimulus check on healthcare related costs

43% feel that their healthcare costs will increase as a result of the 2020 presidential election

Survey methodology

SingleCare’s survey was conducted online by SingleCare on Jun. 3, 2020 through SurveyMonkey. It included 1,000 Americans aged 18+. Sex and age were census-balanced to match the population of the U.S.

Data disclosures

SingleCare data was reviewed and analyzed by the SingleCare team as of Jul. 7, 2020.